Retail looks beyond its old love — the movies

In 2019, toy retailers were blessed with the holiday release of hit movies like “Frozen II” and “Star Wars: The Rise of Skywalker,” as well as a robust list of releases earlier on in the year. Included in the list of spring and summer blockbuster films from 2019 are: “The Lion King,” “Avengers: Endgame,” “Toy Story 4” and “Spider-Man: Far From Home.”

Those are the types of films that adapt easily to the toy market and can notch a meaningful difference in performance.

“When it’s a really hot movie, like in years past Star Wars or some of the Disney movies that are out, they can really be significant drivers of sales,” Joe Feldman, senior retail analyst at Telsey Advisory Group, said. “And they can become the must-have toy for a particular holiday season.”

Hasbro’s entertainment and licensing business reached $115.8 million in the third quarter of 2019, up 20% from the previous year, and the company touted the early customer enthusiasm for its “Frozen II” and Star Wars products. Then the pandemic happened. Movie theaters closed, films got delayed and toy companies were left hanging. The impact is still being felt on movie theaters: Regal Cinemas’ parent company filed for bankruptcy this September.

“The licensing business tied to entertainment has been just a huge component of the U.S. toy industry going back decades,” James Zahn, editor-in-chief of trade publication The Toy Book, said in an interview. “What happened when the pandemic hit is that the licensing and the products became terribly out of sync because we started having delayed theatrical releases.”

According to Zahn, “Trolls World Tour” was one such victim, with product hitting shelves in February 2020 and the movie not hitting screens until the spring. Toys related to “Minions: The Rise of Gru” and “Top Gun: Maverick” suffered similar issues. Still, sales were not as catastrophic as one might think.

In 2020, Hasbro’s licensing business fell below 2018 levels, tumbling 23% from last year to $89 million, but overall industry toy sales through August that year grew 19% year over year, according to Juli Lennett, U.S. toys industry adviser at the NPD Group. They grew another 19% through August of 2021, and were up 3% year over year through August this year. For the 12 countries NPD is currently tracking, licensed toys are outperforming the market.

This year, toy companies have something to look forward to again. Hasbro executives cited Marvel’s “Black Panther: Wakanda Forever” among seven blockbuster films the company was merchandising against, and a lineup of more than 20 streaming or TV shows. But in the intervening years of a pandemic-challenged entertainment business, toy companies have survived without the robust support of major theatrical releases and eager movie-goers.

“This year specifically, we probably have the least reliance on theatrical releases tied to toys going into the holiday season that I’ve seen in several years with the exception of the big superhero movies,” Zahn said, citing the Black Panther film and DC Comics’ “Black Adam.”

Instead, toy companies are capitalizing on evergreen intellectual property like Star Wars and leaning into faster manufacturing cycles to jump on whatever entertainment customers are turning to, big screen or not.

It’s not that the movies don’t matter anymore: Blockbusters will always be important sales drivers, and a rebounding movie business is good news for toy companies. But frankly, my dear, the toy industry doesn’t need movies the way it used to.

‘Squid Game’: ‘Nobody expected that’

Movie ticket sales are still significantly down compared to pre-pandemic years (2021 ticket sales were about 50% behind 2019). The licensed toy business that relies on those films, on the other hand, is up.

Currently, the licensed toy market makes up 31% of total toy sales, according to Lennett, which is one of the highest levels in almost 20 years of tracking. That number is also up about four share points since 2019, which was a much better year for movies.

That’s not to say there was no sales impact from the lackluster movie scene on the toy industry. Zahn, who regularly conducts store visits, observed heaps of licensed toys sitting on shelves or heavily discounted over the past couple of years, suggesting retailers were struggling to sell some of their licensed merchandise. The total impact on the market is hard to gauge, though, since overall toy sales are up. He estimates that whatever impact the struggling movie business had on toy companies, it probably hit toward the end of 2020 or early 2021 and is mostly gone now.

Where is the growth coming from if movies are lagging? Collectible toys continued to perform strongly even with the lack of feature films, as classic franchises drove sales, according to Zahn. Lennett gives at least some of the credit to the rising adult market, which grew during the pandemic.

“I think it’s really that adult market’s love for nostalgia, and kind of thinking about times when they were happier and more childlike,” Lennett said. The pandemic forced adults inside and the desire to reconnect with nostalgic franchises grew. “So they turned to things like Star Wars and Jurassic and Marvel and DC Comics, and things like Pokemon and sports trading cards. All of those things performed well during the pandemic and are performing well now.”

But even with sales up in the toy industry, there are some downsides to the lagging film market. Before the pandemic, major theatrical releases provided toy companies not just with merchandising opportunities, but also with multiple chances to market them. There was marketing during the theatrical release itself, and then a second opportunity to boost sales when a film hit streaming or home video, according to Zahn.

“Theatrical films aren’t necessarily driving the buzz the way they used to.”

James Zahn

Editor-in-Chief of The Toy Book

Now, with many movies going straight to streaming platforms, there’s only one sales opportunity — and it’s not as effective.

“Streaming is not driving consumer product sales as much as a big theatrical release was,” Zahn said. “But at the same time, theatrical films aren’t necessarily driving the buzz the way they used to. And again, that’s another pandemic-related side effect, which is that less people are going to the movies, so it makes streaming more important.”

Zahn used Disney’s “Lightyear” as an example. The merchandise for the movie was “tremendous,” Zahn said, but the film didn’t resonate with audiences as much as expected, leaving product on the shelves.

Streaming is an imperfect solution to the struggling movie business, but it is still driving sales. Companies often see a sales bump during the week that a show first comes out, or sometimes when new episodes are added, according to Zahn. But the amount of new content on streaming platforms means that it’s easy for shows and movies to get buried.

“They don’t necessarily have that long-term hype of a movie that is maybe the subject of national conversation for 30, 60, 90 days to fuel people into the stores,” Zahn said. Even for popular streaming shows like “Stranger Things,” toy companies “want to have that product ready to go in stores, on shelves, as soon as that show hits streaming, because if they come in late, they’ve already lost their buzz. So it sort of shortens the window. It’s the old ‘strike while the iron is hot’ type of scenario.”

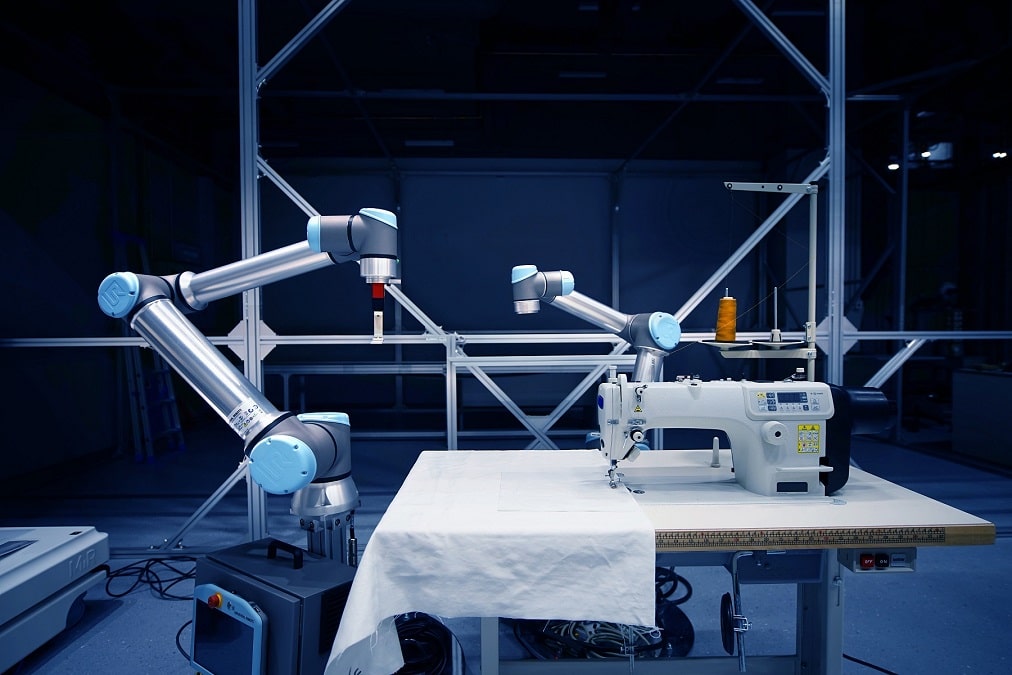

Striking while the iron is hot requires faster manufacturing cycles than toy companies are used to. Everyone in the toy industry likely remembers the incredible popularity of Baby Yoda and the almost audible cries of despair from parents who couldn’t find toys of the character that Christmas.

“It’s no longer just about a movie release, it’s about really the entire ecosystem around it.”

Juli Lennett

U.S. Toys Industry Adviser at the NPD Group

Despite missing the initial hype, Mattel was able to get a product designed and onto shelves in under six months, which was “almost unheard of” in the toy space at the time, Zahn said. The average manufacturing process took closer to 18 months, but that type of speed is now necessary for companies looking to take advantage of streaming hits that become unexpectedly popular.

“If you get everything out there when it comes out and the show flops, then you’ve got a problem with inventory sitting that nobody wants. But on the other side of it, you get a ‘PJ Masks’ that everyone is into and you lost a year’s worth of sales because you didn’t know it was going to become such a juggernaut,” Zahn said. “‘Squid Game’ — nobody expected that.”

Toy companies are getting better at moving faster, but challenges remain. Zahn cited Disney’s “She Hulk” and “Obi-Wan Kenobi” as examples where the shows drove strong conversations and yet the toys were nowhere to be found.

Luckily, toy companies have more reliable forms of income to supplement with. And they’re leaning on them more as the film industry flounders.

‘The Barbie movie will drive toy sales, 100%’

Perhaps one of the biggest tailwinds for the toy industry is that there are already plenty of popular movie franchises in existence. “Harry Potter” remains a staple on toy shelves despite the last film coming out over a decade ago. And the pool of content from which toy companies can pull has grown far beyond new releases to include streaming shows, video games, books, social media and other forms of entertainment. That diversification means a slower movie business is less impactful.

“The strengths of any one of those areas in a given season — sure, it can help be an incremental boost,” Feldman said. “But I don’t know that it means if there’s no big blockbuster Star Wars movie, that there’s not going to be toy sales of Star Wars.”

Interest in Star Wars has also been kept alive by shows like “The Mandalorian” on Disney+. Lennett noted a similar halo effect for the “Jurassic World” business, which supplemented feature-length films with a Netflix show called “Jurassic World Camp Cretaceous.” So even with a smaller sales boost from streaming, companies can keep interest in a franchise alive.

“But I still do not think there has been … a legitimate toy hit driven by streaming in its entirety,” Zahn said. “There are some that are getting close, like ‘Bluey’ for example. ‘Bluey’ is a huge hit right now, but that show is also on regular TV so it’s not purely a streaming play.”

“So many of the hot brands now were hot 20 years ago.”

James Zahn

Editor-in-Chief of The Toy Book

The key is for content creators to figure out a balance for hot franchises that takes advantage of the benefits of the theatrical experience and supplements those major releases with streaming, Zahn said.

“It’s no longer just about a movie release, it’s about really the entire ecosystem around it,” Lennett said. “So, the fact that the last couple of years have been pretty slow movie years did not stop movie properties or movie licenses from performing well.”

Blockbusters are now just one of multiple tools toy and entertainment companies can draw on to fuel interest in new franchises or drive renewed attention to properties that have existed, in some cases, for decades. Mattel and Hasbro have taken to creating films based purely on their popular toy properties. The “Transformers” movies have been “very successful” in driving toy sales, according to Lennett. And Barbie — the iconic doll that has been around for more than 60 years — is getting a star-studded movie next year as well.

“The Barbie movie will drive toy sales, 100%. There are a lot of grandmothers and mothers who played with Barbie. I’m 58 years old — I played with Barbie … a lot of women in particular have those nostalgic memories of playing with Barbie,” Lennett said. “I could see three generations going to see that movie together.”

The evergreen nature of Barbie and other toys, like Care Bears or Hot Wheels, gives a sense of stability to toy companies. They’ve become far less reliant on hit TV shows or movies, Zahn noted.

“So many of the hot brands now were hot 20 years ago, 30 years ago, 40 years ago. And they keep coming back around because we’ve reached this cross-generational peak now where kids that played with this stuff are now parents, grandparents, aunts and uncles themselves,” Zahn said. “So by leaning into those evergreen brands, they really counteract putting all their eggs in the blockbuster theatrical basket.”

In a way, the decline of movies is showing toy companies just how big the world is.

“It’s not just about movies anymore,” Lennett said. “There are so many different ways to reach the consumer.”